Corporate LinX - Documentation Library

How to Pay an Invoice with PayRef

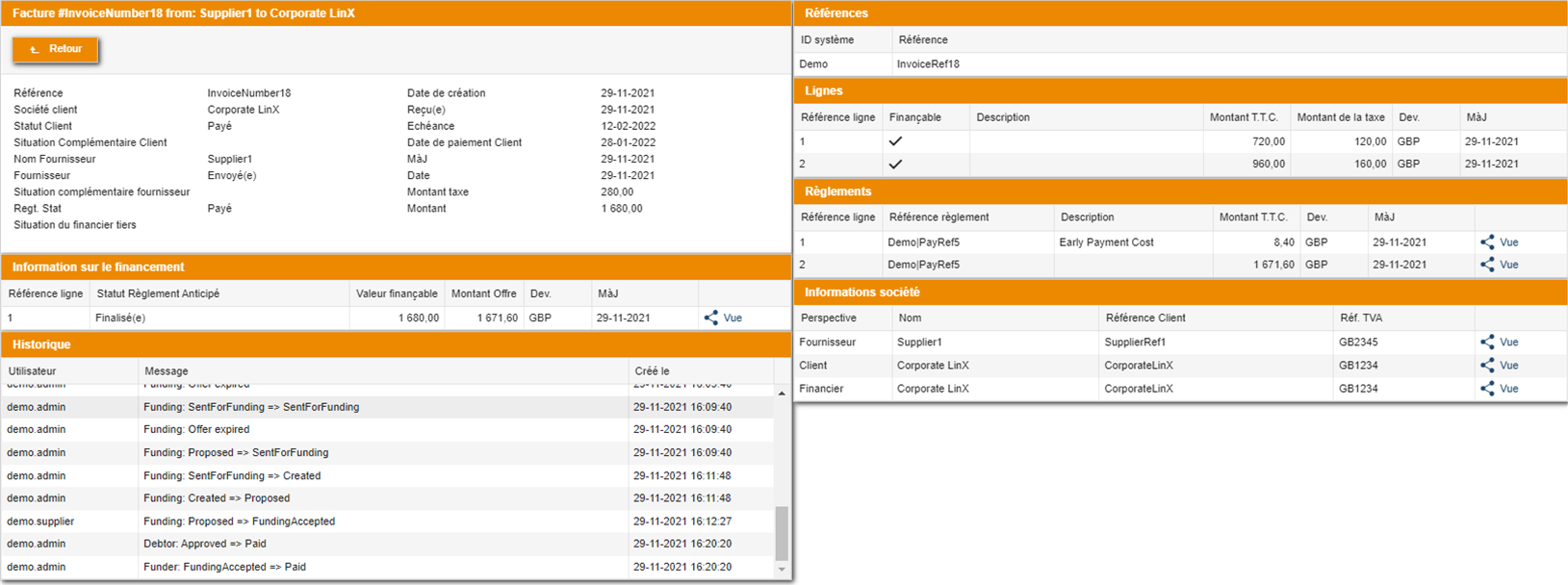

The way in which you can tell our system that a transaction has been paid is by setting a value in the PayRef field in your transactions file. At this time, the state of the transaction also has to be in the state of "Paid" so that it's displayed as such in our portal.

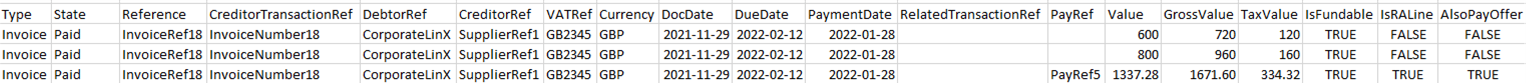

Type;State;Reference;CreditorTransactionRef;DebtorRef;CreditorRef;VATRef;Payref;Currency;DocDate;DueDate;PaymentDate;GrossValue;TaxValue;PayRef;IsFundable;AlsoPayOffer

Invoice;Paid;InvoicRef18;InvoiceNumber18;CorporateLinX;SupplierRef1;GB2345;GBP;2021—11-29;2022-02-12;2022-01-28;;;600;720;120;True;False;False

Invoice;Paid;InvoicRef18;InvoiceNumber18;CorporateLinX;SupplierRef1;GB2345;GBP;2021—11-29;2022-02-12;2022-01-28;;;800;960;160;True;False;False

Invoice;Paid;InvoicRef18;InvoiceNumber18;CorporateLinX;SupplierRef1;GB2345;PayRef5;GBP;2021—11-29;2022-02-12;2022-01-28;;PayRef5;1337.28;1671.60;334.32;True;True

Viewing this Payment information in Excel gives you:

As you can see, the State is still set to Paid, in order for our UI to display the Invoice in the correct state. Here, the third line values are that of the offer you wish to be paid. Value is the offer value excluding tax, Gross Value is the value of the offer including tax and the Tax Value is the total VAT on the offer. The screenshot below shows how this data translates within our UI. If you wish to see the related offer information it can be found in the Offer History grid.

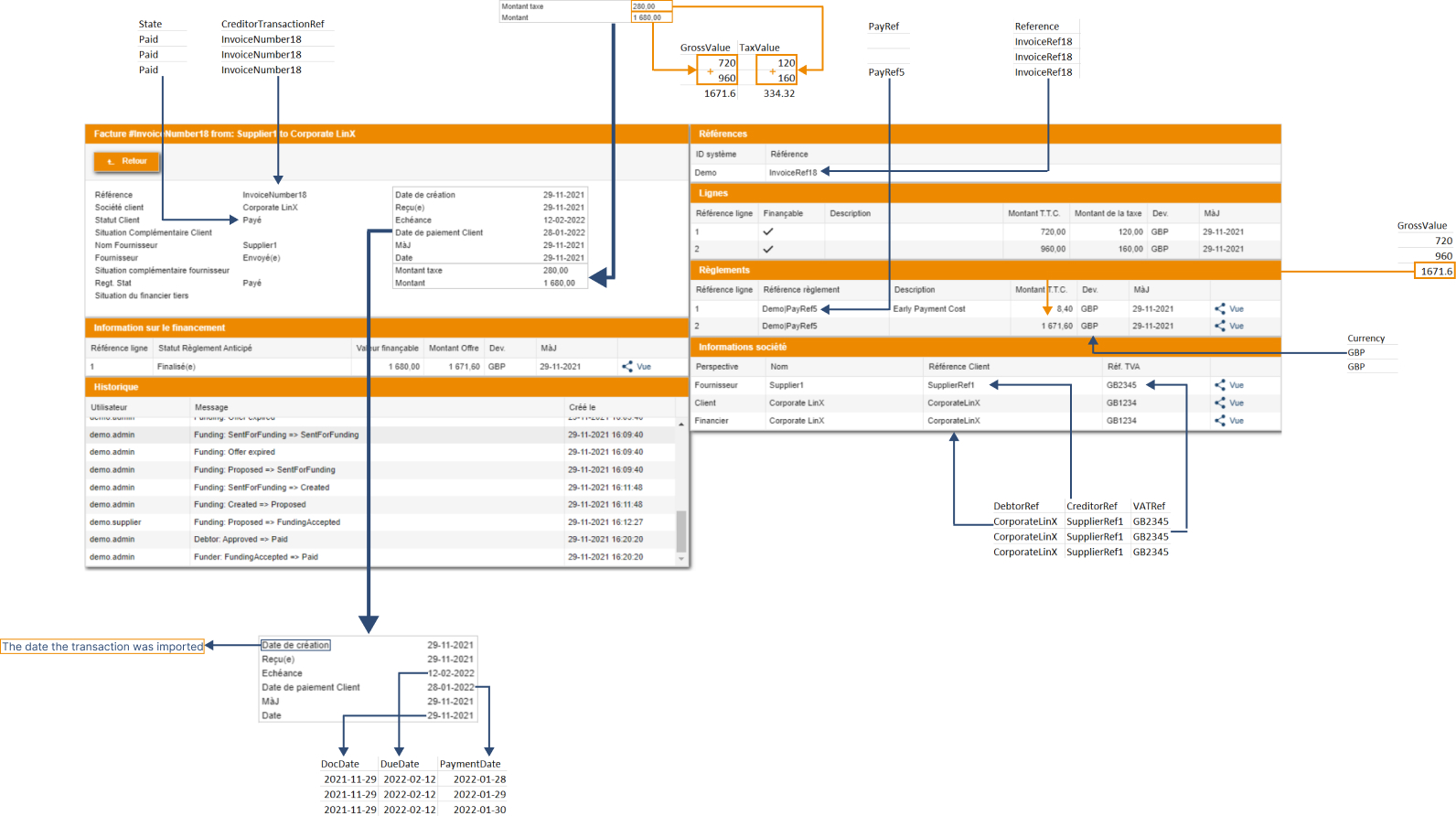

Sometimes it can be difficult to understand how the data you send to us in your CSV transactions file will present itself in our UI. The following diagram breaks down how the payment data you send to us is displayed: